Quick Summary :

The financial world is susceptible to risks emerging from global market dynamics, political decisions, interest rate changes, investor trends, credit situations, and liquidity issues. The age of tech has also added cyber risks, online fraud, and reputational risks (slander campaigns on social media). Data analytics in finance is the bulwark, a defensive wall against all these risks, and the latest competencies in predictive analytics in finance are further revolutionizing the risk mitigation strategies for the finance industry.

Traditionally, financial managers used their risk-identifying skills and available data on paper, policies, financial records, and more to assess and mitigate risks in their business. Insurance against financial risks was a kind of safety net that many financial institutions used heavily to safeguard against such risks.

However, insurance is a reactive approach to risk, not a prevention strategy.

Fast forward to today, and wow, things have changed dramatically! Today, financial managers are inclined towards proactive risk management measures rather than reactive ones. Instead of relying on papers, manual analysis of risks, and static models (that check for risks after a while, like quarterly reviews or annual audits), financial managers look for real-time risk management.

How is this achieved?

The answer is—data analytics and the power of AI in risk management. These two tech collect, measure, process, and analyze financial data from various sources to detect all risk factors related to the financial aspect of the business.

Data analytics in finance also helps businesses categorize risks into low, medium, and high factors, and therefore, businesses can set priority levels to address risks based on their intensity levels.

Importance of Data Analytics in Finance for Mitigating Risks

The concept of risk management in finance is not a new development. Even in the 1950s and ’70s, Modern Portfolio Theory by Harry Markowitz in 1952 and the Black-Scholes-Merton model in 1973 were all about balancing risks and rewards in financial investments. However, there were no cyber risks to finances in those times.

By the 1980s and ’90s, risk management got fully integrated as a key element of strategic planning or scenario planning activities. Risk management theorists started using words like operational risks, reputational risks, and strategic risks to categorize risks.

The most innovative addition to risk management in finance theories was J.P. Morgan’s Value-at-Risk (VaR) concept. The famous dictum– “How much money can we lose in a day, with 99% confidence?” is still a standard today for many conservative financial managers.

Today, with the emergence of other risks like cyber threats, the finance industry has developed a comprehensive Enterprise Risk Management (ERM) model that decides all strategies, tools, tech, and steps that organizations should take to mitigate risks. Financial analytics is a core component of enterprise risk management.

Data analytics technology and data analytics consulting bring with them greater accuracy, faster insights, constant availability, and capabilities to analyze huge amounts of data for risk analysis.

From credit risk assessments and market risk analysis to fraud detection in financial transactions and anomaly detection, data analytics and AI/ML are the key to all these risk management maneuvers.

AI automates everything by removing manual interventions in data analysis and deploying machine learning algorithms that are trained to detect financial risks.

Types of Financial Risks that Data Analytics Can Solve

1. Market Risks

Market risk emerges when asset values fluctuate due to market conditions. Banks use Value-at-Risk (VaR) models to calculate potential losses.

For example, investment banks can use financial analytics to predict how a 2% interest rate hike affects their portfolio.

Modern banks analyze thousands of market variables daily to anticipate volatility. Trading companies can use data insights to adjust positions before market downturns, potentially saving millions.

2. Credit Risks

Credit risk occurs when borrowers default on loan obligations. Lenders can use data analytics-powered credit scoring models to predict default probability.

For instance, credit card companies can analyze spending patterns to identify risky customers before defaults happen.

They can lower their card limits or put restrictions on spending based on data analytics.

Research studies show that machine learning credit models improve default prediction accuracy. Banks analyze payment history, debt ratios, and behavioral patterns through data analytics. A mortgage lender might identify at-risk borrowers during economic downturns and offer refinancing options proactively.

3. Liquidity Risks

Liquidity risk happens when firms can’t meet short-term obligations without substantial losses. Banks use cash flow analytics to monitor their funds and debts.

Financial institutions can use advanced liquidity analytics to maintain a higher buffer ratio during market stress. This is done via data analytics models and finance analysis tools that simulate hundreds of scenarios daily to test liquidity resilience.

4. Operational Risks

Operational risk stems from failed internal processes, people, or systems. Banks can use pattern recognition to detect unusual operational activities.

This is done by analyzing thousands of datasets regarding transactions.

For example, payment companies and banks can analyze transaction processing times to identify slow transaction scenarios and improve before these cause payment failures.

5. Compliance Risks

Compliance risk arises from violations of laws, regulations, industry standards, or mandatory SOPs. Financial institutions can use data analytics to monitor deviations from the standard approach.

For instance, a stock trading company can analyze trading data of its clients, staff, and advisors to detect potential insider trading. This can safeguard the company from regulatory action and penalties.

Real-time risk management challenges overwhelming your financial team? Gain proactive control with X-Byte’s comprehensive data analytics consulting services.

6. Fraud Risks

Banks can use sophisticated data analysis tools for anomaly detection.

For example, a credit card company can analyze millions of transactions daily to flag potential credit card fraud, or a bank may use the same to block suspicious wire transfers. This type of business intelligence in banking is key to mitigating fraud risks.

Machine learning algorithms are trained for this. Data analytics is immensely helpful in fraud detection endeavors.

7. Systemic Risks

Systemic risks are interconnected risks that, if not addressed promptly, may collapse the whole organization or even a financial system in a particular region.

Big organizations like the Federal Reserve Bank, Federal agencies, and regulators use predictive analytics in finance to monitor loans, liquidity, and capital markets to identify and anticipate any high-level systemic risks that may cause a financial crisis

8. Model Risks

Model risk emerges when financial models provide inaccurate outputs. Banks use backtesting and benchmarking to validate model performance.

For example, JP Morgan’s “London Whale” incident resulted from flawed VaR models, costing $6 billion. Data analytics-based model validation can identify critical model weaknesses before implementation.

Financial institutions can compare model outputs against multiple benchmarks daily to identify flaws in their models and make adjustments as required.

9. Reputational Risks

Reputational risk impacts stakeholder perception and brand value.

Financial institutions can use sentiment analysis by tracking social media data, review data, and feedback data from multiple sources to detect any mass slander campaign, negative perception building, or poor sentiments among customers to detect a reputational crisis before it escalates.

This can be done by data analytics models with NLP integration that track online mentions for the brand and detect public perception based on trained models.

10. Interest Rate Risks

Interest rates are not in any financial institution’s hands. Decided by the Federal Reserve or central banks, the key interest rates, like repo rates, affect financial institutions across the world.

However, these rates are decided based on market factors, inflation, job data, and liquidity positions.

Financial institutions can use data analytics to predict whether interest rates will be increased or decreased, or kept as it is in the next monetary review.

11. Foreign Exchange Risks

Currency risk arises from exchange rate fluctuations. Multinational banks can use correlation analysis to understand currency pair movements.

For instance, a multi-national bank might analyze how Brexit news affects GBP/USD rates before executing large trades. Such predictive currency analytics can reduce hedging costs while maintaining protection.

Financial institutions can also monitor macroeconomic indicators across multiple countries simultaneously using data analytics models.

12. Concentration Risks

Concentration risk emerges from overexposure to particular sectors, counterparties, or regions. Financial organizations can deploy diversity metrics to identify unhealthy or overexposures.

For instance, an ETF might analyze its commercial loan portfolio to avoid overconcentration in retail properties. Concentration analysis can prevent sector-specific losses during any market U-turns.

Data Analytics Models and Approaches that You Need to Solve Financial Risk Management Woes

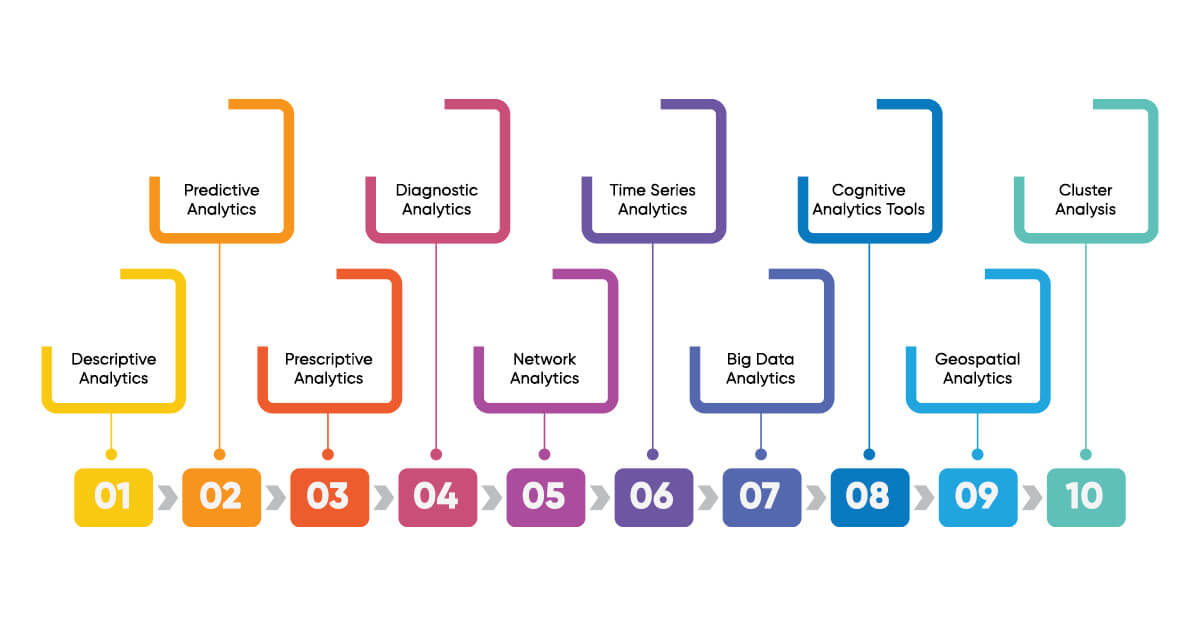

1. Descriptive Analytics

Remember those quarterly reviews and annual audits we talked about earlier?

Descriptive analytics is essentially that, but supercharged! It analyzes historical data to answer “what happened?” in your financial operations.

Financial institutions are increasingly using new types of data and advanced analytical techniques, with over 60% of surveyed institutions reporting increased usage of descriptive analytics.

Descriptive analytics provides the foundation for understanding patterns and creating dashboards that highlight risk hotspots before they escalate. Tools like Power BI in finance are key to visualizing the data generated by descriptive analytics.

2. Predictive Analytics

What if you could peek into the future of financial risks? That’s predictive analytics. Moving beyond what happened to forecast what might happen, this approach uses statistical models and machine learning to predict potential risk events.

AI/ML models are primarily gaining traction for risk scoring of small and medium-sized enterprises and early warning systems across various business segments.

By analyzing patterns in historical data, financial institutions can prepare for emerging risks instead of merely reacting to them.

Market volatility and credit risks threatening your financial stability? Transform uncertainty into opportunity with X-Byte’s predictive analytics solutions.

3. Prescriptive Analytics

Prescriptive analytics doesn’t just tell you what might happen, it recommends what you should do about it.

Using complex algorithms, prescriptive models evaluate numerous scenarios and suggest optimal actions.

While specific metrics on its effectiveness vary across institutions, the value proposition is clear: prescriptive analytics helps optimize resource allocation and provides actionable guidance for navigating financial uncertainties.

4. Diagnostic Analytics

Financial organizations may wonder about the unexpected liquidity crunch that happened last quarter.

Diagnostic analytics digs into the “why” behind these financial events. By examining correlations and causation factors, this approach helps risk managers understand root causes.

According to Harvard Business Review, diagnostic analytics helps organizations identify strategic risks, which can result from pressures due to growth, culture, or information management issues.

For example, a bank might use diagnostic analytics to determine why a particular loan portfolio is underperforming by examining multiple factors simultaneously.

5. Network Analytics

Financial systems are incredibly interconnected. Data collected from network devices employed by financial institutions, like switches, routers, wireless, databases, computers, employee devices, etc., is analyzed to find network risks like latency issues, slow networks, and congestion.

Network analytics is where relationships between networks, devices, entities, transactions, markets, and even customer experiences are mapped for risk management.

6. Time Series Analytics

Time series analytics models forecast future metrics, capture temporal patterns in financial flows based on certain triggers or data patterns.

For instance, you launch a new product feature every third quarter for a software product, and you see a spike in sales in the next quarter; this has a time series correlation.

If you launch the feature in the second quarter and find that there is no sales spike, it means launching the product in the third quarter is more profitable. Such data analysis mitigates risks based on time, seasons, and market cycles.

7. Big Data Analytics

Big data analytics in finance is the most popular of the data analytics used in finance. Big data analytics has been used since the 2000s, when top finance firms like Goldman Sachs., JP Morgan and Morgan Stanley started using high-frequency algorithms for trading. These all started processing data to conduct algo-powered trading.

Today, big data analytics takes care of the high-volume data that industry mammoths like the above-mentioned finance companies create.

Big data analytics applies AI, data analytics, and the power of machine learning to unearth metrics that help in risk mitigation strategies.

8. Cognitive Analytics Tools

Many critical Financial metrics or customer sentiments often hide in plain text like annual reports, news articles, regulatory filings, social media posts, and more.

Cognitive analytics tools based on Natural language processing (NLP) competencies can extract insights from these text sources and detect various types of risks.

NLP-based data analytics tools are key to counter sentiment risks, employee attractions, board member disagreements, and more.

9. Geospatial Analytics

Financial risks aren’t distributed evenly across the globe, and geospatial analytics helps visualize these geographic patterns. By mapping financial data to physical locations, this approach identifies regional risk concentrations.

Geospatial analytics in finance relates maps and location data to financial implications. It evaluates locations to make smarter financial decisions by interpreting financial risks related to cities, countries, and regions. Geospatial finance analytics is crucial for mapping physical risks to investments like government polices for a particular area, floods, lockdowns, riots, and wildfires. It helps answer questions like “Where should we build?” or “How might climate change affect our investments?” It lowers location-specific risks in finance.

10. Cluster Analysis

Birds of a feather flock together! Cluster analysis groups similar financial entities based on shared characteristics, helping identify risk segments. Investors apply cluster analysis to create a trading strategy that aids in constructing a diversified portfolio.

Stocks with strong return correlations are grouped, while those with lower correlation are categorized separately, continuing this process until every stock is classified accordingly.

Powerful Data Analytics Tools and Technologies for Financial Risk Management

| Category | Tools and Technologies |

| Financial Data Processing Platforms | Python with financial libraries (NumPy, Pandas, SciPy)R for statistical computingApache Spark for large-scale data processingHadoop for distributed data storage and processing |

| Analytics Software Solutions | AI-powered analytics with natural language capabilities Comprehensive risk management solutions Risk analytics and portfolio management software Tableau for data visualization Power BI for financial dashboards |

| AI and Machine Learning Technologies | AI-based credit risk assessment modelsDeep learning models (RNNs and LSTM networks) for market risk forecastingNatural language processing for sentiment analysisPredictive and geospatial analytics tools |

| Real-Time Analytics | Real-time data monitoring systems for continuous risk assessmentAutomated alerting systems for potential issuesDynamic dashboards for visualizing risk exposures |

| Integration and Data Management Tools | API integration solutions for connecting multiple data sourcesData warehousing solutions (Snowflake, Google BigQuery)ETL (Extract, Transform, Load) tools for data preparation |

| Specialized Risk Management Tools | Fraud detection systems with anomaly detection capabilitiesCompliance management software with regulatory reporting features |

Conclusion

Today’s financial markets operate at lightning speed, and global economic factors intertwine more intricately than ever before. The risks have increased, too, and it compels financial organizations to shift from reactive safeguards to proactive risk intelligence powered by data analytics. The integration of data analytics into risk management frameworks provides the ability to not just respond to risks but to anticipate and neutralize them before they materialize.

This comprehensive exploration delves into how data analytics is revolutionizing financial risk management across multiple dimensions. Organizations that need sophisticated predictive models that process billions of data points in real-time and want to mitigate risks across multiple dimensions of their finance business can book X-Byte’s finance data analytics consulting services.

From market volatility and credit defaults to cybersecurity threats and reputational damage, we provide customized consulting and solution development guidance for each risk type. Our tools and services, like Power BI development services, are part of the comprehensive toolkit designed for A to Z financial risk management.

Unmanaged risks can cascade rapidly. Embrace proactive risk intelligence in finance with our data analytics services.